In March 2021, the UK Government announced a reform of its alcohol duty system, including proposals to tax all products on the basis of strength (by ABV). Further, under the new system, stronger products would be taxed at higher rates – reflecting evidence that higher ABV drinks are both disproportionately drunk by heavier drinkers and associated with greater levels of intoxication. Upon their announcement, these reforms aimed to simplify and rationalise the UK tax system and were explicitly linked to a desire to improve public health.

Prior to the implementation of the new duty structures in August 2023, the UK Government also announced that there would be a concurrent 10.1% increase in all duty rates. This increase reflected the very high levels of general price inflation globally in the preceding 12 months, referred to in the UK as the ‘cost-of-living crisis’.

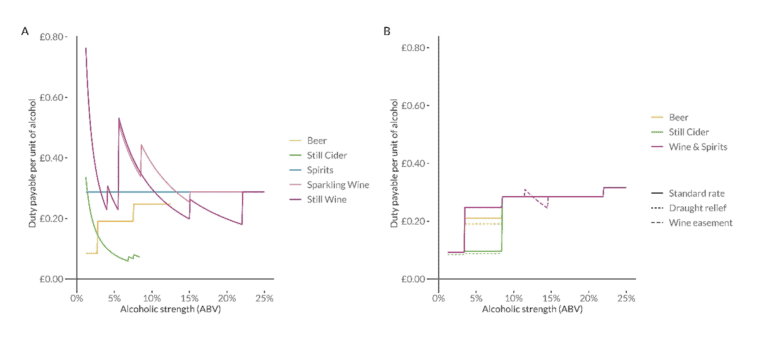

The first graphic shows the structures of the old (Panel A) and new duty systems (Panel B) payable per unit of alcohol where one UK unit of alcohol equals 10ml or 8g of pure alcohol. Under the new system all alcohol is taxed based on the alcoholic strength of the product.

Although these duty reforms and increases have now been implemented, there has been little research to date to understand their potential impact on consumer spending, and none on the extent to which different groups in society were exposed to any resulting price increases. We therefore aimed to address this gap by estimating:

- The potential impact of the UK duty reforms and increases on consumer spending.

- The separate impacts of the changes to the duty structures, changes to duty levels and the temporary wine easement.

- How these impacts vary between households depending on their level of alcohol purchasing and their socioeconomic position.

What we did

We analysed data on alcohol purchases from the household panel survey Kantar’s WorldPanel from August 2022-July 2023, the 12 months immediately prior to the implementation of the duty reforms. We analysed four alternative scenarios, reflecting the three separate components of the duty reforms (the changes to the duty structures, the temporary wine easement and the additional 10.1% increase in duty rates):

- Duty structure changes only, with wine easement

- Duty structure changes only, without wine easement

- Duty structure and rate changes, with wine easement

- Duty structure and rate changes, without wine easement

We calculated the total amount of duty payable on every alcohol purchase made prior to the duty changes and then calculated the duty that would be payable under each of our four scenarios. We assumed that the households did not change their spending habits in each of the four scenarios, so the amount of alcohol they purchased is the same in the before and after period. We wanted to observe how households would be impacted if they kept the spending habits consistent.

What the study found

Alcohol Purchaser Quintile

In the 12 months prior to the implementation of the duty reforms the mean household spend on off-trade alcohol was £324.37. However, this average conceals a heavily skewed distribution, with the lowest-purchasing 20% of households spending an average of £20.47 on alcohol per year compared to £1,206.68 for the highest-purchasing 20% of households.

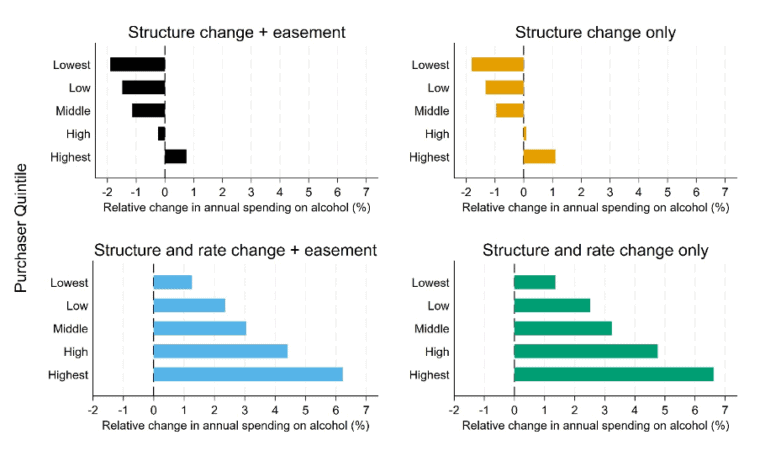

At a population level, the changes to the duty structure alone are estimated to increase the average annual spend for households that buy alcohol by £1.91, a 0.59% increase. Adding in the effect of the wine easement reduces this increase to £0.87 (+0.27% relative to pre-duty change). The impact of the increase in duty rates with wine easement is substantially larger, increasing household spending by an average of £17.42 per year, a 5.37% rise, and this is estimated to increase further to a total increase of £18.58 (+5.73%) when the wine easement is removed.

In absolute terms this is unsurprising, since households that buy the most alcohol would expect to see the biggest increases in spending through any increase in price. However, the fact that this pattern persists in the relative impacts highlights that the reforms are also increasing the prices of the products that are purchased disproportionately by households that buy more alcohol.

Socioeconomic Status

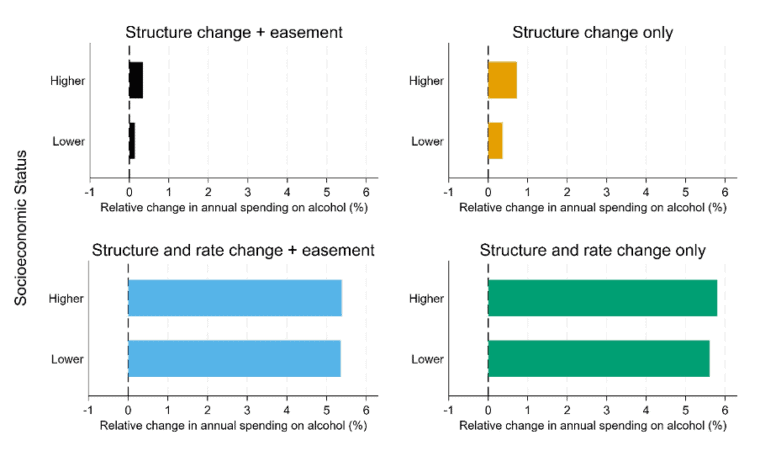

We also examine the extent to which exposure to the duty reforms varies across socioeconomic position. We find that households with higher socioeconomic positions, not only purchased more alcohol on average than their lower socioeconomic counterparts, but are more exposed to the reforms – facing a larger impact from the structural changes alone (+0.34% compared to +0.14% under structure change + easement) although this gap is narrowed once the impact of the increase in duty rates is accounted for (+5.38% compared to +5.36% under structure and rate change + easement).

Implications

Our results provide some support for the structural reforms to alcohol duty introduced in the UK in August 2023 being effectively targeted at the heaviest alcohol purchasers, with no evidence to suggest that they are likely to increase economic inequalities. The increase in alcohol duty rates is likely to have had a substantial impact on household spending on alcohol, however it is important to place this increase in the wider context, with alcohol duty rates in the UK having been cut in cash or real terms almost every year for the past decade. Therefore, while our analysis suggests the potential for positive public health impacts of the duty reforms due to their targeted design, it is unlikely that the reforms alone will counteract the negative effects of the overall real-terms decline or have a significant impact on rising rates of alcohol harms.

Written by Dr Luke B. Wilson, Research Fellow, Sheffield Addictions Research Group.

All IAS Blogposts are published with the permission of the author. The views expressed are solely the author’s own and do not necessarily represent the views of the Institute of Alcohol Studies.