View this report

In the Autumn Budget 2025 there were three key announcements:

- All alcohol duty rates will go up by RPI inflation in February 2026

- Small Producer Relief will be increased

- The National Licensing Policy Framework was published

After the increase, alcohol duty will still be much lower than it was in 2012/13. In real terms:

- Beer duty will be 32% lower

- Draught beer duty will be 42% lower

- Cider and spirits duty will be 26% lower

- Draught cider duty will be 36% lower

- Wine duty will be 19% lower

Alcohol trade bodies responded with predictable misinformation and provably wrong economic analysis.

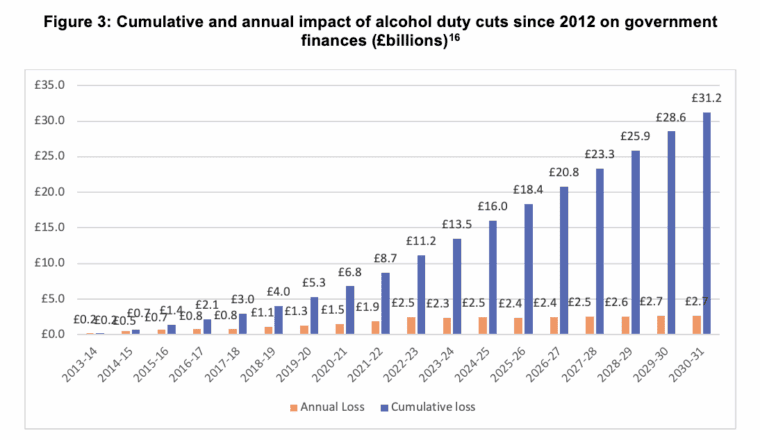

Cumulatively, duty cuts from 2013/14 onwards will have cost the Treasury £31.2 billion from 2013-2031, compared with if duty had been raised in line with inflation.

Recommendations:

- Raise alcohol duty above inflation each year, targeting off-trade alcohol.

- Ultimately, develop a mechanism that ensures alcohol duty rates cover the external cost of alcohol harm to society and incentivises alcohol producers to reduce harm.

- Equalise cider duty rates with that of beer of the same strength (ABV).

- Separate the licensing of on- and off-trade licensed premises, seizing the opportunity of the licensing reforms, particularly to tackle the harmful impact of off-trade alcohol e.g. rapid online deliveries.

View this report