View this report

- In the Spring Budget 2023 there were two key announcements:

- Most alcohol duty will go up with RPI inflation in August 2023

- Draught Relief – part of the Reform of Alcohol Duty – will be increased

- This follows a freezing of alcohol duty from February to August, announced in

December 2022 - After the increase, alcohol duty will still be much lower than it was in 2012/13. In

real terms:- Beer duty will be 29% lower

- Draught beer duty will be 36% lower

- Cider and spirits duty will be 23% lower

- Draught cider duty will be 30% lower

- Wine duty will be 15% lower

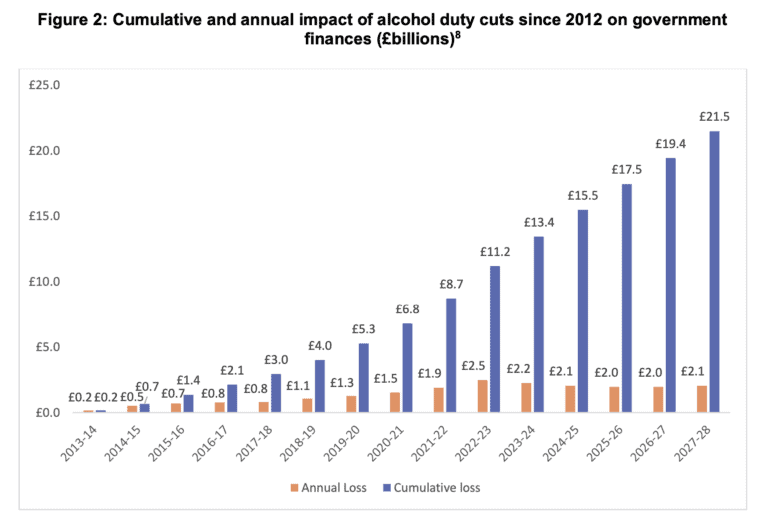

- Cumulatively, duty cuts will cost the Treasury over £21.5 billion from 2013-

2028, compared with if duty had been raised in line with inflation as was planned - The Reform of Alcohol Duty will commence in August 2023. Under the new

system, all products will be taxed according to their strength - There will be a temporary 18-month period in which all wines of strength 11.5-

14.5% will use an assumed strength of 12.5% - We support the shift to a more proportionate system, however, we have a

number of concerns and recommendations:- The rates are set too low – they should at least cover the £27 billion cost of alcohol harm to society

- Cider is still being preferentially treated with lower rates than the same strength beer, which is likely to continue to cause harm. They should be equalised

- Duty should be de-politicised and automatically uprated in line with inflation or earnings yearly, instead of being considered at each Budget

View this report