On this page

The alcohol industry can be defined in various ways, with no agreed settled definition. The term is most commonly used to refer to corporations engaged in the production of alcoholic beverages. However, broader definitions also exist. The World Health Organization, for example, refers to ‘manufacturers of alcoholic beverages, wholesale distributors, major retailers and importers that deal solely and exclusively in alcohol beverages, or whose primary income comes from trade in alcohol beverages’, a definition that has been adopted by Public Health England (PHE).

PHE’s definition also includes entities that are dependent on funding and support from the industry, such as business associations or other non-state actors representing or funded largely by any of the previously outlined entities, as well as: industry lobbyists; coalitions; corporate philanthropic foundations; charities; and social aspect (public relations) organisations (SAPROs).

The alcohol industry exerts significant influence, not only in its commercial activities but also over social and political perceptions and responses to alcohol. It does so through a variety of activities, including: the development of alliances, with trade associations and SAPROs, and with non-industry allies such as think tanks; and corporate social responsibility programmes.

The Institute of Alcohol Studies has estimated that the production and sale of alcohol was worth £46 billion to the UK economy in 2014, accounting for 2.5% of Gross Domestic Product and 3.7% of all consumer spending. The vast majority of the economic value of alcohol production in the UK comes from two different activities: brewing beer for the domestic market (largely to be sold in the on-trade) and distilling spirits for export (predominantly Scotch whisky).

As well as making and selling alcohol, researchers have identified five different ways in which industry actors seek to influence regulation:

- Constituency building

- Policy substitution

- Information and messaging

- Financial incentives

- Trade and litigation

This page contains detailed information on how the alcohol industry operates.

Facts and stats

- The World Health Organization defines the alcohol industry as: “Manufacturers of alcoholic beverages, wholesale distributors, major retailers and importers that deal solely and exclusively in alcoholic beverages or whose primary income comes from trade in alcohol beverages, as well as business associations or other non-State actors representing any of the afore-mentioned entities. Other non-State actors who are engaged in the sale of alcohol, receive funding from the alcohol industry (including funding for research) or have intrinsic links to the above-mentioned entities should be reviewed on a case by case basis in order to determine whether they should also be viewed as ‘alcohol industry’.” (WHO)

- The industry’s value chain is supported by a number of collective bodies, which give producers a voice in the public sphere.

- This includes trade associations (e.g. The Scotch Whisky Association) and ‘social aspects and public relations organisations’ (SAPROs, e.g. Drinkaware)

- This is for off-trade sales only, which makes up the majority of alcohol sold in the UK.

- In 2022, there were 158,000 licensed on-trade premises, including pubs and bars. The largest UK pub operators are:

- 73% of alcohol consumed in the UK is purchased from off-trade premises (BBPA 2023, Table B11).

- Major grocery retailers represent two-thirds of off-trade sales.

- Specialist alcohol retailers and corner shops represent 25%.

- Convenience stores represent a tenth.

- Industry actors seek to influence policy by framing arguments around alcohol in a way that places responsibility on a minority of ‘problematic’ individual consumers, and thus away from alcohol itself, the industry’s practices and population-level policy measures. (McCambridge, 2018)

- The alcohol industry’s actions to influence policy and regulation are similar to that of the tobacco industry’s actions. (Bond, L. et al., 2010; Savell, E. et al., 2016; McCambridge, J. and Morris, S., 2019)

- Researchers have identified 5 key ways in which the industry attempts to influence regulations (Savell, E. 2016)

- Constituency building:

- Forming industry groups and associations to assist coordination and collaboration

- Forming alliances with sympathetic non-trade bodies e.g. think tanks

- Policy substation:

- Corporate Social Responsibility (CSR) programmes, apparently promoting the social good independently of the government

- Developing self-regulation as an alternative to government restrictions

- Information and messaging:

- Developing evidence: Funding and shaping original research

- Disseminating evidence: collating and interpreting existing evidence, for the public and policymakers

- Lobbying: making direct proposals and representations to policymakers

- Economic incentives:

- Using economic incentives to influence policymakers, particularly employment opportunities and connections

- Trade litigation:

- Shaping trade policy to secure favourable terms and access to new markets

- Using legal challenges to undermine unfavourable policies and regulation (typically on the basis of trade law)

- Constituency building:

Briefings

Reports

Blogs

European health organisations are powerless against the wine lobby

24th February 2026

Is the Great British Pub on the verge of extinction? The truth behind the headlines

10th February 2026

“Ensure these restrictions are not enforced”: FOI documents reveal alcohol industry lobbying

2nd February 2026

Why we should have cancer warnings on alcohol

27th January 2026

Budget 2025: Alcohol duty kept with inflation, but still far from true cost

16th December 2025

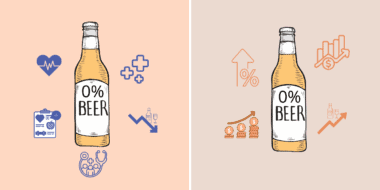

Zero-alcohol products: a tool for moderation or a tool for growth?

26th November 2025

Why we need a long-term vision to tackle alcohol harm in the UK

11th November 2025

Deregulating alcohol licensing: how the government’s proposals risk undermining public health and democracy

4th November 2025